2011 was a difficult year for many investors including me. I had made very good gains up until August of that year only to see much of my year's gains evaporate the following month in September. I had in fact breached the half-million mark then at one point. To say that my mood was euphoric then would have been an understatement. Had I known then that the following month would end up being very bloody for my portfolio I would have exited the market completely.

When it became apparent things were really turning bad, I tried to cut my losses. I wasn’t fast enough. I did manage to eke out a small gain by the end of the year but it was nothing compared to what I had been enjoying just before the breakdown.

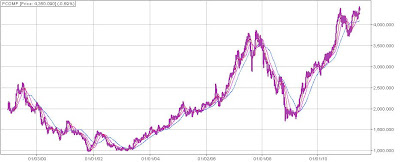

Above is a snapshot of how I did in 2011 and the two months so far in 2012. February is not over yet so the final figure for the month will still change, but things are definitely shaping up for the better. Early on, it looks as if 2012 will be a breakout year for Philippine stocks. The PSEi in fact has broken new highs and is set to go higher this year.

Looking back on my performance on a per year basis I can’t help but be excited. I believe I can outperform my best year so far which was 2010. 2009 by the way is incomplete since I only started recording my progress in May of that year but even discounting that, I know it wasn’t a particularly impressive year. Things are looking up though. Not even two months into the current year and I've already beaten my previous year's record. I hope I can sustain this. And, I hope my gut feel is right because what I sense is that the market is ripe for a very strong and sustained bull run.

Looking back on my performance on a per year basis I can’t help but be excited. I believe I can outperform my best year so far which was 2010. 2009 by the way is incomplete since I only started recording my progress in May of that year but even discounting that, I know it wasn’t a particularly impressive year. Things are looking up though. Not even two months into the current year and I've already beaten my previous year's record. I hope I can sustain this. And, I hope my gut feel is right because what I sense is that the market is ripe for a very strong and sustained bull run.