The Philippine Stock Exchange index is currently the easiest way to gauge the overall performance of the Philippine stock market. It is basically a score that is derived from adding the stock prices of a selection of the top 30 listed companies in the Philippines.

Certain companies are heavier in terms of weight in the index more than others. The differences in weight depend on the companies’ capitalization, meaning the bigger they are, the more weight they carry in the index.

The current composition of the index is the following 30 companies that represent the major sectors such as property, industrial, financial, services, and others.

The following are the companies listed on the PSEi (effective 09 May 2011):

1. Aboitiz Equity Ventures (PSE: AEV)

2. Aboitiz Power (PSE: AP)

3. ABS–CBN Corporation (PSE: ABS)

4. Alliance Global Group, Inc. (PSE: AGI)

5. Ayala Corporation (PSE: AC)

6. Ayala Land (PSE: ALI)

7. Banco de Oro Unibank, Inc. (PSE: BDO)

8. Bank of the Philippine Islands (PSE: BPI)

9. DMCI Holdings (PSE: DMC)

10. Energy Development Corporation (PSE: EDC)

11. Filinvest Land (PSE: FLI)

12. First Gen Corporation (PSE: FGEN)

13. First Philippine Holdings Corporation (PSE: FPH)

14. Globe Telecom (PSE: GLO)

15. International Container Terminal Services Inc. (PSE: ICT)

16. JG Summit Holdings (PSE: JGS)

17. Jollibee Foods Corporation (PSE: JFC)

18. Lepanto Consolidated Mining Company (PSE: LC and LCB)

19. Manila Electric Company (PSE: MER)

20. Manila Water Company (PSE: MWC)

21. Megaworld Corporation (PSE: MEG)

22. Metro Pacific Investments Corporation (PSE: MPI)

23. Metropolitan Bank and Trust Company (PSE: MBT)

24. Philex Mining Corporation (PSE: PX)

25. Philippine Long Distance Telephone Company (PSE: TEL)

26. Robinsons Land Corporation (PSE: RLC)

27. Security Bank Corporation (PSE: SECB)

28. SM Investments Corporation (PSE: SM)

29. SM Prime Holdings (PSE: SMPH)

30. Universal Robina Corporation (PSE: URC)

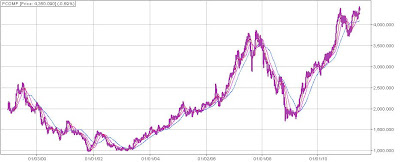

Since stock prices are always changing, it helps to be able to gauge the overall market trend without necessarily monitoring the individual stock prices of all the roughly 250 listed companies. The Philippine Stock Exchange Index or PSEi serves this need.

As of writing, the PSEi closed the day at 4,350.09. Although lower than previous day’s close, we are relatively doing well considering the index had languished below the 4,000 level for quite a long time.

There is much speculation from financial analysts that the index could reach 5,000 by yearend. I think this is very possible. The economic fundamentals of our country are sound and we’ve been attracting a lot of foreign interest of late.

The trick then is to choose the stocks most likely to lead the way for the remainder of the year. These will be the stocks with the best underlying value for the long term. I personally am invested in San Miguel Corporation (SMC), Semirara (SCC), and RFM Corporation (RFM) to name a few. I am also heavily in Lepanto Consolidated Mining (LC and LCB). I think these are a few of the many stocks that hold promise for good returns this year.

No comments:

Post a Comment